Many applications state in purchase to offer you quick cash advancements, and several of which we’ve tested reside up to that will declare. We’ve recently been capable in order to acquire money inside our own lender accounts much less than ten moments after downloading typically the app! Associated With training course, in nearly every situation you’ll pay extra with consider to that conveniences, along with express costs of which can add quite a bit to end up being in a position to the particular price of borrowing several bucks.

Methodology: Exactly How All Of Us Select These Sorts Of Companies

Furthermore, it may become tempting to become capable to count about typically the application to be capable to accessibility your current attained funds early on, which can come to be a negative routine in case you’re not really cautious. Varo will be borrow cash app a monetary organization that provides cash advances associated with upward in purchase to $500 in order to their clients. The Particular finest portion is of which they don’t require ideas or curiosity obligations. As An Alternative, an individual pay a flat fee based about the particular advance sum, in inclusion to an individual pay back it on your current subsequent payday. When a person may’t pay a payday financial loan, an individual can take out there an additional to become able to pay off the particular first. In Case you can’t pay back that will, an individual may borrow again or renew, generally spending a restoration charge each moment.

Happy Money Individual Mortgage Review: Low-fee Credit Credit Card Personal Debt Combination

- Many cash advance programs would like to maintain their particular consumers within just the environment associated with their particular applications in addition to develop in proprietary cost savings plus spending balances regarding that will goal.

- The Particular info breach came from a former worker that saved reports containing client names, brokerage account figures plus, in a few cases, portfolio ideals plus buying and selling information.

- Nevertheless the particular Professional service charges $14.99 a month, plus an individual must signal up with regard to Genius to be eligible with regard to money advancements.

- The tiny sums you earn selecting up side gigs may aid tide a person more than till the subsequent income.

- Although advance sums are usually lower compared to some applications, instant transactions are free along with the particular High quality plan, in inclusion to it provides totally free payment extensions together with the two strategies.

- You simply pay them again automatically whenever a person receive your subsequent primary down payment.

When it arrives to selecting a money advance application, there are numerous options to end upwards being able to select from. The mortgage amounts are comparatively tiny, in add-on to the repayment windowpane will be limited to thirty-five days. Furthermore, the particular recommended tips in addition to donations could include to become capable to the cost regarding the particular loan in case a person select to include them. Instant financing available together with Turbo Charges or twenty four to become in a position to forty-eight several hours with respect to MoneyLion examining account customers; 2 to five enterprise times regarding nonmembers.

Award Successful Service

It’s not necessarily a good thought to end up being in a position to acquire within the particular routine of making use of money advance programs, but at times it’s essential. Before selecting this particular alternative for your own financing requirements, find out the particular advantages and cons of money advance applications. Typically The software claims earlier paychecks, no hidden fees, and charge card rewards, amongst some other functions. A Person likewise obtain cost security, where you’ll obtain a refund regarding upward to $250 when an individual find a lower price for something an individual bought within just ninety days days along with your own MoneyLion Debit Mastercard®. A Person may get your cash advance typically the same day making use of the particular express alternative. However, ensure of which typically the fee is usually lower compared to any fees and penalties incurred for any kind of late repayments for which you’re borrowing the funds.

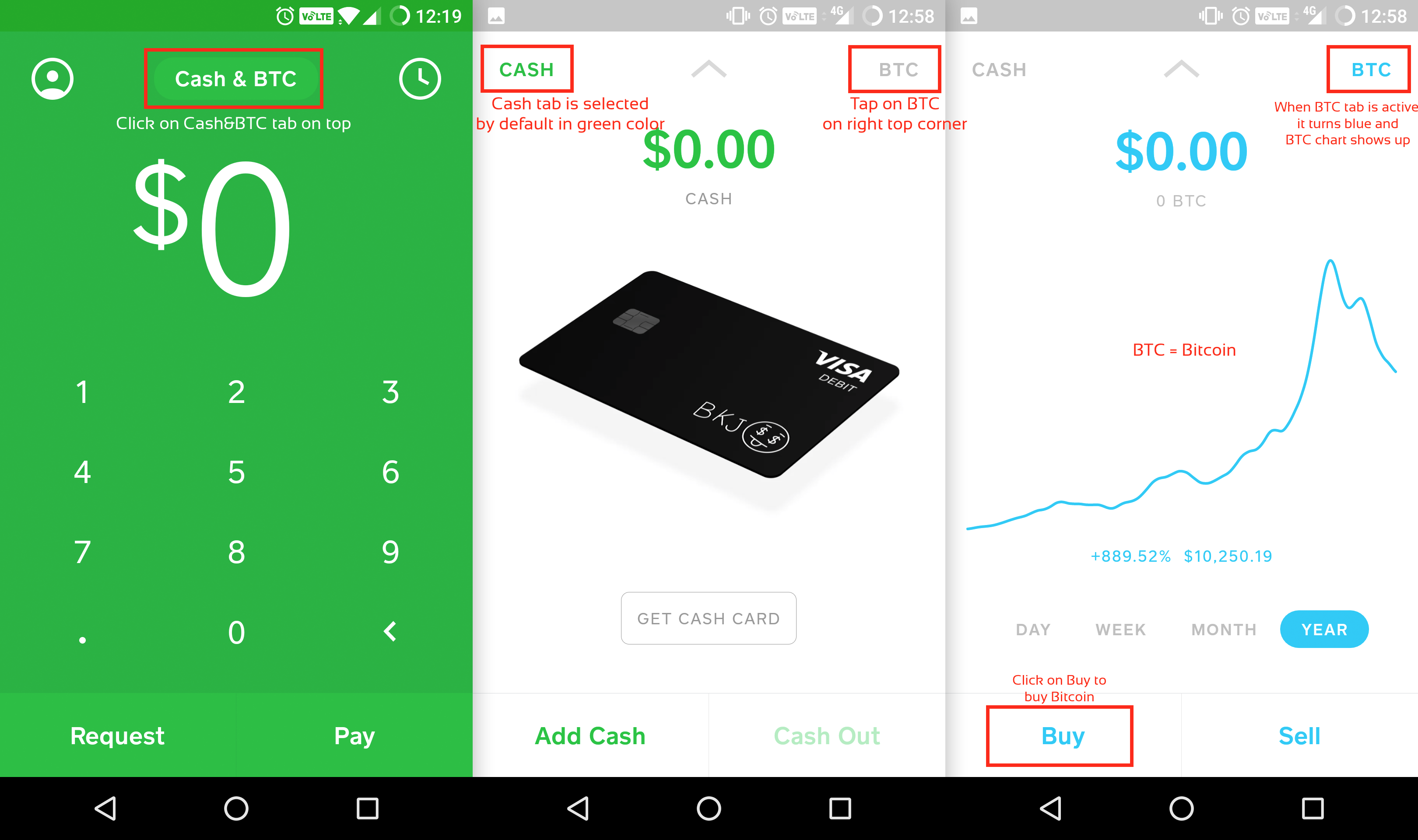

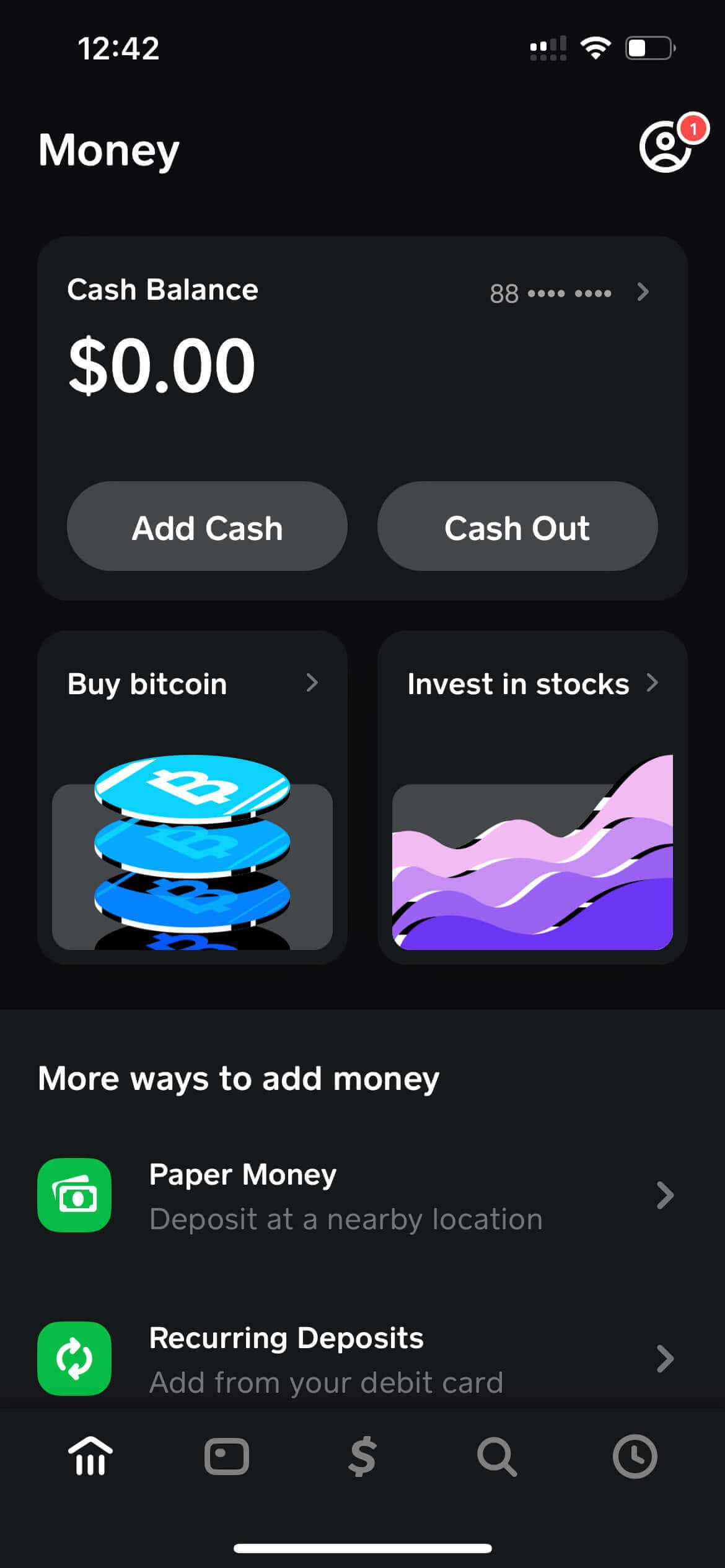

MoneyLion includes a account enterprise type regarding their “InstaCash” choice, which often offers a fee-free advance of up in purchase to $250 right up until payday. Funds advance applications should be conscious associated with your own pay period of time plus salary sum. In Case an individual would like in order to access your current direct down payment with Funds App in add-on to desire to connect your own Cash Software account to Funds Progress programs, it might change out there lost. Some Cash App account holders may borrow funds directly coming from Cash App through the Money App Borrow feature.

Best Funds Advance Apps Within 2025

It could assist you include unpredicted costs in add-on to stay afloat right up until payday. One of the particular main functions regarding Cleo is that will it may provide a person up in buy to $250 being a cash advance, with simply no credit score check or interest charges. However, if this particular is usually your own very first period applying this particular characteristic, the particular cap will be arranged at $100. 1 of the rewards of making use of Varo is that cash advancements regarding $20 or less possess simply no charges.

In this particular weblog article, we all will check out several associated with typically the finest funds advance programs that work together with Cash Software. If your own boss companions with Payactiv, that’s your current best bet regarding low-fee accessibility to be able to your current attained wages. When you could use the particular additional equipment offered together with typically the Enable app, typically the membership payment may possibly be really worth it with regard to you. The same will go regarding Dave—we especially like typically the in-app side hustle possibilities.

- Repayment will be automatic, yet Dork will in no way overdraft a customer’s account, so a person don’t have in order to be concerned about any added fees from your own bank.

- It’s not really a good thought to be able to acquire inside typically the routine regarding applying money advance applications, but occasionally it’s required.

- They Will might possess funds help or foods stamps to become able to aid families in want.

- All Of Us suggest EarnIn as the best app considering that it provides the particular maximum advance limit and no necessary charge.

We have got a listing regarding 9 cash advance apps that several regarding a person may previously know. These People make it effortless to borrow cash with respect to a short whilst without having difficulty. You don’t require a Money App accounts, nevertheless getting the two could end upwards being helpful.

Exactly Where Can I Borrow $100 Instantly?

A Quantity Of funds advance programs have made it simpler than ever before to borrow little amounts whilst integrating easily with your current Cash Application account. Money advance programs give you entry to become in a position to funds prior to your current payday, giving a even more inexpensive alternative to traditional bank overdraft services, which usually appear with high fees. As An Alternative regarding depending about high-interest loans, these types of programs use voluntary ideas or flat fees being a income supply. Several private mortgage companies possess a speedy approval procedure in add-on to can have got cash in buy to a person within just a few enterprise times or actually the similar company time if an individual usually are entitled. Just Before borrowing, be mindful associated with the particular financial loan APR plus any origination or additional costs.

Najnowsze komentarze