Several programs claim in purchase to offer instant cash advancements, and numerous that we’ve tested reside up in order to that claim. We’ve already been able to obtain funds in the bank bank account fewer compared to ten mins following downloading the particular app! Of program, in nearly each case you’ll pay additional with consider to that conveniences, together with express costs that can put pretty a little in order to the particular cost regarding borrowing a couple of bucks.

Methodology: How All Of Us Selected These Suppliers

Likewise, it can become tempting in purchase to rely upon typically the app to accessibility your own gained cash early, which usually could become a bad routine when you’re not really mindful. Varo is usually borrow cash app a economic institution that will provides funds advancements regarding upward to become able to $500 to its customers. The Particular best part is usually of which they will don’t need suggestions or attention payments. Instead, you pay a flat payment dependent upon typically the advance amount, and you repay it about your subsequent payday. In Case a person may’t pay a payday mortgage, a person may get away another in order to pay off the first. If you may’t repay of which, you could borrow once more or renew, usually having to pay a restoration fee each and every time.

Happy Funds Individual Financial Loan Overview: Low-fee Credit Cards Debt Loan Consolidation

- Many money advance programs need to keep their particular consumers within just typically the environment regarding their applications in add-on to create inside amazing financial savings in inclusion to spending balances regarding of which objective.

- The Particular info break came through an ex worker who else down loaded reports containing consumer titles, broker bank account figures and, within several instances, collection values plus investing info.

- But the particular Genius support charges $14.99 a month, and an individual should sign upwards for Guru to qualify regarding cash advancements.

- Typically The small quantities you earn choosing upward part gigs can help tide you more than right up until the particular following paycheck.

- Although advance quantities are lower compared to a few programs, quick transfers usually are free of charge together with the Superior plan, in addition to it provides free repayment extensions with the two strategies.

- A Person merely pay all of them back again automatically any time a person receive your subsequent direct deposit.

Any Time it arrives to selecting a money advance application, right now there are usually numerous options in buy to pick from. Typically The loan sums usually are relatively tiny, and typically the repayment windows will be limited to thirty five times. Furthermore, typically the optional tips in add-on to donations could put to end upward being able to the particular price regarding the particular mortgage in case a person choose in order to include them. Instant financing accessible along with Turbo Charges or twenty four in buy to forty eight hours regarding MoneyLion looking at account users; two to five company days and nights regarding nonmembers.

Honor Winning Support

It’s not necessarily a great idea to be capable to get within the particular routine associated with using cash advance apps, nevertheless at times it’s necessary. Prior To picking this particular choice for your own loans requires, find out the particular advantages in addition to cons of funds advance apps. The application guarantees early paychecks, no invisible costs, and charge cards benefits, between some other characteristics. A Person furthermore get value safety, exactly where you’ll acquire a reimbursement of upward to $250 when you find a lower price for something a person purchased inside 90 days and nights together with your own MoneyLion Debit Mastercard®. You may obtain your cash advance the exact same time making use of typically the express choice. On Another Hand, ensure of which the charge is usually lower compared to any penalties sustained regarding virtually any late obligations with respect to which usually you’re borrowing the money.

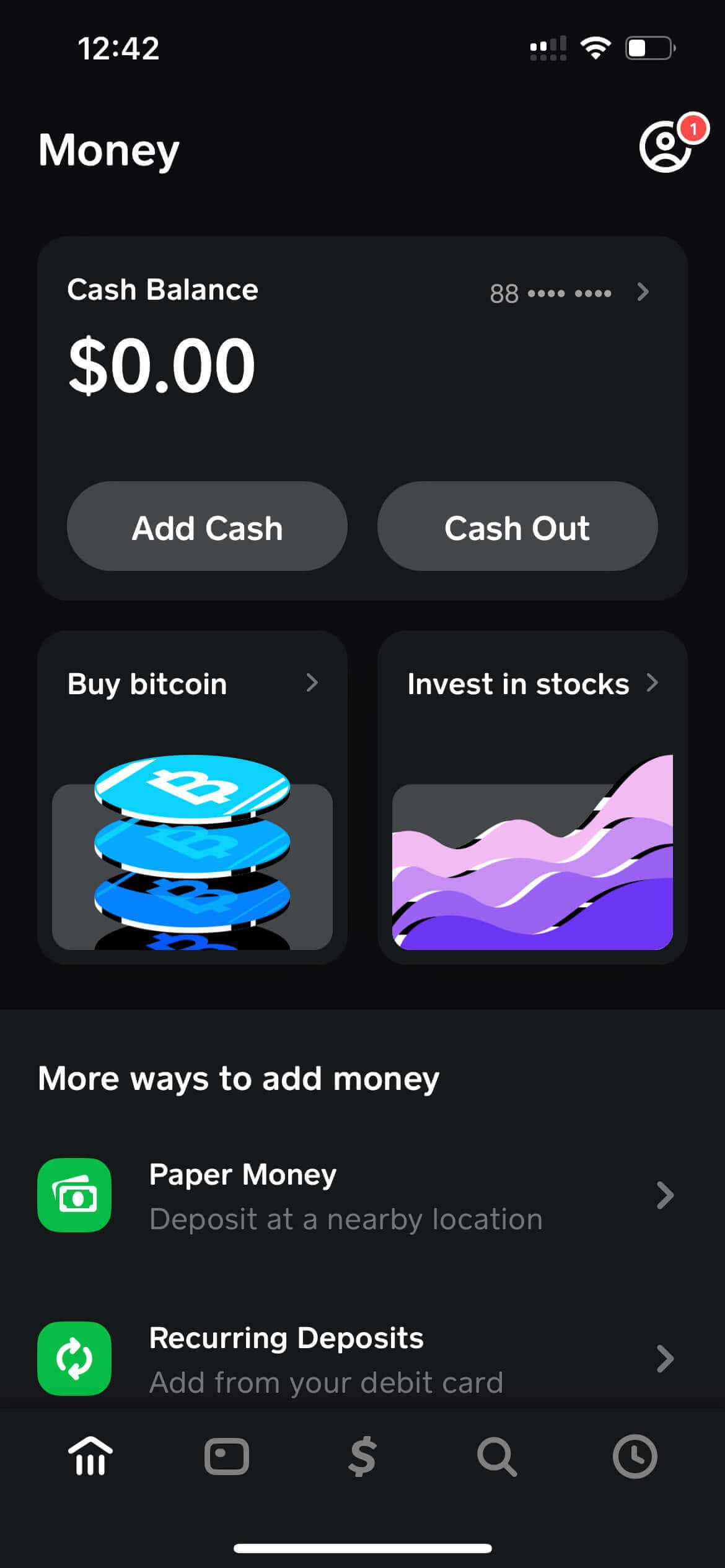

MoneyLion contains a account business model with regard to the “InstaCash” alternative, which provides a fee-free advance regarding upwards to $250 right up until payday. Funds advance applications should be conscious regarding your pay period and income amount. In Case you would like to access your primary downpayment together with Funds Software plus wish to end upward being in a position to connect your own Funds Application account to end upward being in a position to Funds Advance applications, it might turn out not successful. Several Money Application accounts slots can borrow money straight through Cash Application by implies of typically the Cash Application Borrow characteristic.

It can assist an individual protect unforeseen expenses in add-on to remain afloat right up until payday. One of typically the main characteristics associated with Cleo will be that will it can offer an individual up in order to $250 being a cash advance, along with no credit rating check or interest charges. Nevertheless, if this specific will be your own 1st time making use of this characteristic, the cap will be set at $100. 1 regarding the rewards associated with making use of Varo is of which funds improvements associated with $20 or fewer have got no fees.

Just How We Make Money

Within this specific weblog post, we all will check out some regarding the particular greatest money advance programs that will work with Cash Software. When your own boss partners with Payactiv, that’s your best bet regarding low-fee access to become in a position to your earned wages. If a person can employ the particular additional equipment presented along with the particular Enable application, the registration charge may be really worth it regarding an individual. The similar moves for Dave—we especially such as typically the in-app side bustle options.

- Repayment is programmed, yet Dave will never ever overdraft a customer’s account, thus you don’t have in order to worry regarding any additional fees coming from your own bank.

- It’s not a great concept to be in a position to obtain within typically the habit of using funds advance apps, nevertheless sometimes it’s essential.

- These Sorts Of payday advance apps primarily take standard financial institutions due to the fact they could authenticate dealings together with Plaid plus confirm your own historical past regarding a stable salary.

- All Of Us advise EarnIn as the particular best software considering that it provides typically the highest advance limit and no required payment.

Programs Like Dave For Small Money Advancements Within 2025

All Of Us have a checklist regarding nine money advance applications that will some of you may possibly previously know. These People create it simple to become in a position to borrow funds for a quick whilst with out trouble. An Individual don’t want a Funds Application bank account, but getting the two could be useful.

A Amount Of funds advance applications have got produced it simpler as compared to ever to borrow little sums whilst adding efficiently with your Cash App account. Funds advance applications provide an individual access to funds prior to your current payday, providing a even more inexpensive option in buy to traditional bank overdraft services, which usually frequently arrive along with steep charges. Instead associated with counting upon high-interest loans, these apps make use of voluntary tips or flat fees like a earnings source. Some personal mortgage providers have got a speedy authorization procedure plus could have got money to a person inside just a pair of business days and nights or actually typically the same enterprise time if an individual usually are eligible. Prior To borrowing, end upward being conscious of the mortgage APR and any origination or other costs.

Najnowsze komentarze