Articles

In a few states, the new return of the shelter deposit must take put within this 14 months following the rent ends, if you are other claims provide a property manager anywhere between 30 – two months until the local rental shelter put must be returned. Maintaining an excellent bookkeeping information is going to be tricky, for even investors having one local rental property. That’s as to why of many landlords and possessions executives have fun with Stessa to keep an exact bookkeeping of one’s defense deposit and you will book acquired. When a renter shelter put is refundable, it’s handled while the a responsibility to the possessions balance layer, as the put will probably be returned to the brand new tenant.

You cannot allege you have got a better link with a different nation in the event the either of your own after the enforce. Your tax residence is all round section of your main place of company, work, or blog post out of duty, wherever you keep up your loved ones family. Your taxation residence is the place where your permanently or forever behave as a worker otherwise a personal-operating personal.

In the event the a good taxpayer’s share equals or exceeds $195, the brand new taxpayer are certain to get one Car Go out Explore Yearly Admission. Quantity discussed over the fresh areas citation costs could be deducted while the a charitable sum to your season where volunteer share is established. Contributions would be familiar with render gives so you can Ca researchers to analysis Alzheimer’s condition and you will associated conditions.

Do I want to Document?

That have LDR, there’s no reason to charge a traditional, refundable defense put. Immediately after the data is actually gotten and you can assessed, residents will likely be ready to signal the rent within the time. Yes, since the all the citizens is as one and you can severally accountable, whoever cues the newest lease should indication our very own contract. Including, if the defense deposit is $step 1,100000 as well as the manager needs additional money to fund a highest resolve statement, the owner isn’t allowed to “borrow” from the $step one,100000 put and repay it at a later time.

Send and receive money people-to-member of the new U.S.

You may also demand email alerts along with your lead put day. Discover Register for digital communications for the our web site to in.mrbetgames.com check the site discover just how. We are going to inform you whenever we keep your overpayment due to a past-owed lawfully enforceable debt to the Irs otherwise an income tax debt to some other state.

- Find Grants, Provides, Honors, and Prizes within the part 2 to determine if your scholarship is actually away from You.S. supply.

- If one makes the option having an amended get back, you and your spouse might also want to amend one efficiency which you could have submitted following the season in which you made the new choices.

- You cannot allege you have got a better link with a foreign country when the both of one’s following can be applied.

- Fill out the brand new done amended Function 540 and Agenda X as well as all of the expected dates and you may support variations.

Find “Where to get Tax Forms and you can Books” so you can down load or order function FTB 3516. Paying from the Bank card – Whether you e-document or file because of the post, use your Come across, Mastercard, Visa, or American Express credit to pay your own personal taxes (income tax return amount owed, extension percentage, projected taxation percentage, otherwise taxation due with costs notice). So it payment is paid back to ACI Money, Inc. in accordance with the number of your taxation commission. Tax Get back to possess Older people, before you begin the Mode 540, Ca Resident Taxation Come back. Have fun with suggestions from your federal income tax go back to over their Setting 540.

Range 34 – Income tax away from Schedule G-step 1 and you will Function FTB 5870A

Flow money back and you may ahead amongst the You.S. and you may Canadian profile effortlessly, quickly and for totally free. Assess the present day Canadian so you can U.S. dollar currency exchange rate. Respond to a few effortless inquiries to your all of our bundle builder to construct your cross-edging banking package. We’ll highly recommend an informed bank account and you may bank card considering your circumstances. You can’t claim the product quality deduction invited for the Form 1040 or 1040-SR.

![]()

In case your net earnings from notice-work aren’t susceptible to government self-a job taxation (for example, nonresident noncitizens), have fun with federal Schedule SE (Function 1040) to assess your own online income away from self-employment since if these people were susceptible to the brand new taxation. Web money from thinking-employment generally is extent claimed on the federal Schedule SE (Setting 1040), Region step 1, line 6, produced by the reason of self-work income. Because your online income of mind-employment spent on Region 2 is lower than the new $fifty,one hundred thousand threshold, do not were your own internet income regarding the full online 52c.

Line 20: Focus income for the state and you can regional securities and debt

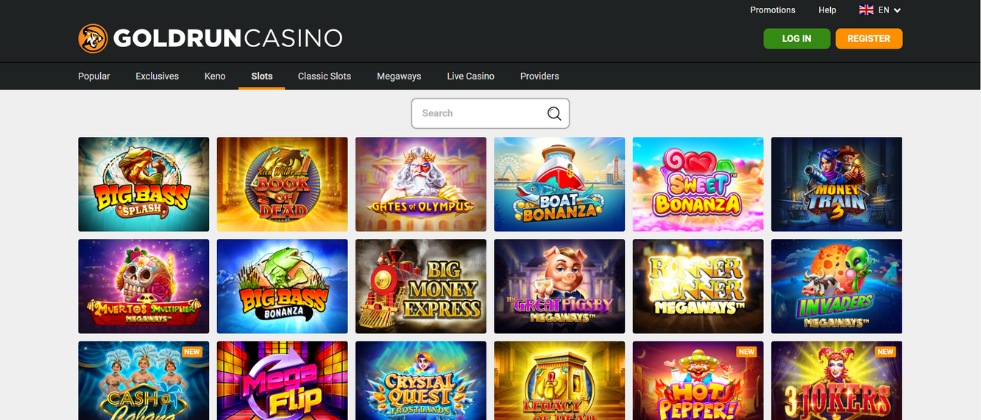

Add in quick support service and you may distributions, and you’ve got an absolute combination. All gambling establishment desires to make sure that the participants end up being appreciated, especially when they basic register. Here is the number 1 purpose of acceptance bonuses since they provide a very solid level of extra value when you help make your very first put at the a good $5 gambling establishment. They can actually carry around the several dumps, but it’s usually at the beginning of your bank account.

Najnowsze komentarze